Top 10 Best Silver Coins to Invest in 2024

Looking to invest in silver coins in 2024? This guide highlights the best silver coins to invest in 2024 for your portfolio. You'll find top choices like American Silver Eagle, Canadian Silver Maple Leaf, and more. Whether you're a seasoned investor...

Looking to invest in silver coins in 2024? This guide highlights the best silver coins to invest in 2024 for your portfolio. You'll find top choices like American Silver Eagle, Canadian Silver Maple Leaf, and more. Whether you're a seasoned investor or just starting, these recommendations will help you make an informed decision.

Introduction to Silver Investing

Silver investing has gained significant traction among those seeking to diversify their investment portfolios and safeguard their wealth in uncertain economic times. Silver coins stand out as a favored choice, offering a blend of investment potential, liquidity, and collectibility that appeals to both new and seasoned investors. With a wide array of silver coins available on the market, investors can select from various designs, purities, and origins to match their financial goals and personal preferences.

The best silver coins for investment are typically those produced by sovereign mints, such as the Royal Canadian Mint, United States Mint, and Perth Mint. These institutions guarantee the weight, silver content, and purity of their coins, providing peace of mind and confidence to buyers. Popular silver bullion coins like the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic are highly respected in the precious metals market for their quality and global recognition. Whether you’re looking to add stability to your investment portfolios or simply appreciate the artistry of silver, these coins offer a reliable and attractive entry point into the world of precious metals.

Key Takeaways

-

The top silver coins for investment in 2024 include the best-selling silver coins such as the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic, all known for their high purity, popularity, and market recognition.

-

Investors should consider factors such as purity, design, limited mintage, and authenticity when selecting silver coins to ensure wise investment choices.

-

Silver bullion coins are valued for wealth protection, offering advantages like affordability and liquidity, making them a practical choice for diversifying investment portfolios and safeguarding assets against economic uncertainties.

Types of Silver Coins

When exploring the world of silver coins, investors and collectors will encounter several distinct types, each with its own advantages. Bullion coins, such as the American Silver Eagle and Canadian Silver Maple Leaf, are minted primarily for investment purposes and are valued for their high silver content—often 99.9% or higher. These coins are a popular hedge against inflation and economic uncertainty, making them a staple in many investment portfolios.

Proof silver coins are another category, produced in limited quantities with exceptional craftsmanship and intricate designs. Their mirror-like finishes and collectible appeal make them highly sought after by silver enthusiasts. Junk silver coins, on the other hand, are older coins—like pre-1965 U.S. dimes, quarters, and half dollars—that contain a lower purity of silver but are valued for their silver content and historical significance. For those seeking a more affordable alternative, silver rounds offer privately minted options that closely resemble bullion coins in appearance and silver content, but typically carry lower premiums.

Whether you’re interested in the iconic maple leaf design of the Canadian Silver Maple, the trusted reputation of the American Silver Eagle, or the affordability of junk silver coins and silver rounds, there’s a silver coin to suit every investment strategy and budget.

American Silver Eagle

The American Silver Eagle shines as a premier option among silver bullion coins, boasting a composition of 99.9% pure silver. As the official silver bullion coin of the United States government, it is government guaranteed for weight, purity, and authenticity.

Globally recognized and respected for its high-quality standard, this coin’s allure is heightened by the classic Walking Liberty design crafted by Adolph A. Weinman, which originally appeared on the Walking Liberty Half Dollar issued in 1916. This connection to the half dollar underscores the coin's deep roots in American numismatic history and craftsmanship.

The reverse of the American Silver Eagle features a heraldic eagle, symbolizing American strength and heritage. In recent years, the design has also showcased the American Bald Eagle, a powerful emblem of freedom and national pride.

Its standout feature is the ease with which it can be traded in the market — a testament to its status as one of the most liquid options for those interested in silver investments. The coin's weight is precisely one troy ounce, as guaranteed by the United States government, further establishing trust for investors and collectors.

The American Silver Eagle provides investors with swift buying and selling opportunities, positioning itself as an exceptionally versatile addition to any investment portfolio. Silver Eagles and American Silver Eagles are highly liquid due to their government backing, making them a preferred choice for both collectors and investors.

As we move into 2024, enthusiasts will note that there are two distinct versions of the American Silver Eagle: Proof and Bullion. Collectors gravitate towards the meticulously struck Proof version for its polished shine.

At the same time, investors typically opt for the straightforward Bullion variant intended primarily for their portfolios’ diversification goals—meeting varied interests across collectors’ preferences or investment strategies.

Canadian Silver Maple Leaf

The Canadian Silver Maple Leaf is a prominent silver bullion coin worldwide. Since its first entry into the market in 1988, it has earned widespread acclaim and trust from silver investors.

Each coin is adorned with an image of Queen Elizabeth II as a nod to its historical importance.

This particular silver maple leaf is renowned for its exceptional purity level—the fine silver within boasts a remarkable 99.99% purity grade, setting it apart as one of the highest-quality options among bullion coins.

The weight matches up to one troy ounce or 31,11 grams, ensuring investors receive a significant amount of physical silver.

The security measures implemented into these coins are top-notch, featuring advanced security features that solidify their integrity against counterfeiting attempts through radial line engravings and milled edges.

The adoption of MintShield technology in 2018 represented another leap forward by minimizing unsightly milk spots on these pieces.

Looking ahead to future collectibility prospects, the upcoming introduction in 2024 will feature King Charles III’s portrait as part of the new obverse design, Increasing its allure amongst collectors and investors alike.

Austrian Silver Philharmonic

Silver bullion investors highly regard the Austrian Silver Philharmonic for its aesthetic beauty and substantial silver content. Produced by the Austrian Mint, a renowned European institution, this coin stands out among European coins.

It is the only silver coin denominated in euros, making it unique and highly sought after by collectors and investors. The coin's design is a key factor in its appeal, showcasing Austria’s notable musical history and cultural heritage.

The obverse features the Golden Hall of Vienna's Musikverein, a symbol of Austria's rich musical tradition. The reverse features a collection of musical instruments, further emphasizing its connection to the arts and enhancing its collectible value.

Each piece of this exquisite series consists of 1 troy ounce (31.10 grams) of 99.9% pure silver. Its legal tender value is €1.50, which serves dual purposes: collectibility and investment security.

The combination of its fineness, striking design elements, and weight makes it an exceptional selection within the expansive realm of silver bullion coins.

British Silver Britannia

Introduced in 1997 after the acclaim of the Gold Britannia, the British Silver Britannia coin is produced by the Royal Mint, renowned for its reputation and historical significance. This coin stands as a testament to Britain’s rich legacy.

It showcases excellence in British minting craftsmanship and is adorned with an iconic image of Britannia wielding a trident and shield, emblematic of strength and defense.

Renowned for its sterling silver purity level of 99.9%, this coin has earned recognition among silver investors due to its superior quality.

The combination of artistry and advanced coin features, such as micro-texture lines, laser-engraved marks, and other security designs, ensures that each piece remains distinctive while offering protection against counterfeiting. These coin features make it an attractive asset for any investor interested in high-grade silver content like that found within the British Silver Britannia.

Mexican Silver Libertad

With its stunning depiction of the Winged Victory statue and Mexican volcanoes, the Mexican Silver Libertad coin is celebrated for its aesthetic charm and cultural significance.

The composition of this coin boasts a 99.9% silver purity level, enhancing its appeal to investors.

Due to its comparatively limited production runs, the Mexican Silver Libertad is distinct from other bullion coins. The coin's scarcity can boost demand and raise its worth in future years.

As it possesses legal tender status, it offers a blend of visual splendor and monetary benefit that appeals to collectors and investment enthusiasts alike.

Australian Silver Kangaroo

Since its debut in 2016, the Australian Silver Kangaroo has quickly become a noteworthy option among bullion coins.

Featuring the emblematic image of a bounding red kangaroo, this coin is recognized as an important symbol from Down Under. With each piece crafted from 99.99% pure silver, investors can be assured they are acquiring a significant asset.

Regarding safeguarding investment, the Australian Silver Kangaroo sets itself apart through advanced security measures like incorporating laser-engraved privy marks to prevent forgery.

This focus on protection positions it among the most secure bullion coins on offer today. The introduction of King Charles III’s effigy, released in 2024, elevates its desirability as a collector’s item.

Each Australian Silver Kangaroo coin has both monetary and visual appeal. Its weight is fixed at one troy ounce, and its face value is AUD 1.

This makes these coins particularly attractive to those who invest in silver bullion and appreciate numismatic design and significance. The Australian Silver Kangaroo is also a popular choice for those interested in precious metals investing.

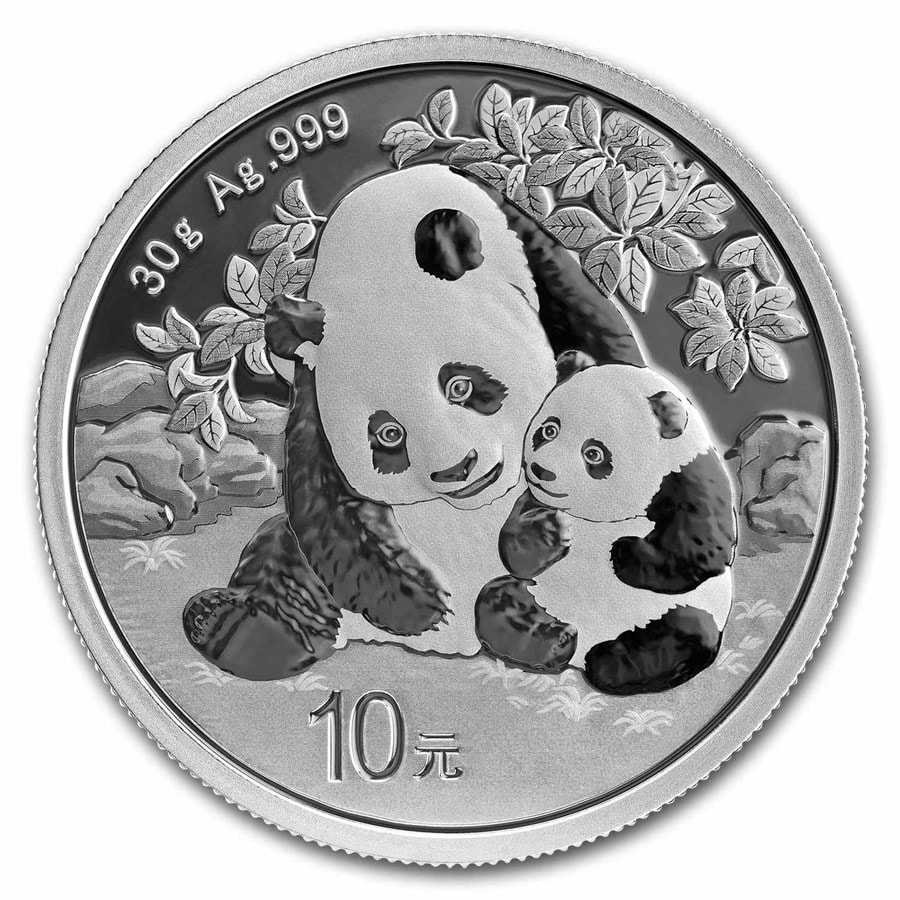

Chinese Silver Panda

Collectors and investors alike are drawn to the Chinese Silver Panda coin, renowned for its distinctive design and limited production runs.

Starting in 1983 with manufacturing in Shanghai, this series has grown into a highly sought-after collectible item. The reverse side of each coin depicts the Beijing Temple of Heaven, an important cultural site. The Chinese Silver Panda series often features annual design changes inspired by the Chinese lunar calendar, with zodiac animals and cultural motifs enhancing its collectible appeal.

Beginning in 2016, the sizing format of these coins was altered from troy ounces to grams to conform to international metric standards.

These coins are composed of 99.9% pure silver and maintain their investment value. Their nominal value of 10 Yuan enhances their allure as part of any collection dedicated to silver coins.

Morgan Silver Dollar

The Morgan Silver Dollar, containing 99.9% pure silver and weighing 0.77344 troy ounces, is respected for its numismatic value and place in U.S. history. Morgan Silver Dollars are highly sought after by silver collectors due to their classic American design and historical significance.

Adorned with revered designs such as Lady Liberty and the Bald Eagle, Morgan Silver Dollars have captured the attention of coin enthusiasts.

Despite having a nominal value of one dollar, this storied coin frequently commands prices far exceeding that due to its intrinsic silver content and historical importance. Lower-quality coins can sometimes be acquired at prices just above the current silver spot price, making them accessible to a wider range of investors. As such, collectors often consider the Morgan Silver Dollar an attractive addition to their investment collections for portfolio diversification purposes.

Silver Krugerrand

Introduced in 2017, the Silver Krugerrand is a newcomer to the world of silver bullion coins, yet it has quickly gained respect for its quality. As part of the broader interest in the African wildlife coin series, which also features coins like the Somalian Silver Elephants, the Silver Krugerrand stands out among many other bullion coins for its unique design and investment potential.

The coin comprises one troy ounce of .999 fine silver, guaranteeing its premium standard. A Springbok antelope graces the reverse side as an emblematic figure of South Africa, and on the obverse is depicted Paul Kruger.

Boasting a nominal value of 1 Rand, this silver coin is celebrated for its fineness and solidifying itself in market circles. Like many other bullion coins, it marries cultural importance with financial appeal, rendering it an essential component within any collection aimed at diversifying one’s holdings in silver assets.

Junk Silver Coins

Silver coins produced in the United States before 1965 are commonly known as junk silver coins and typically possess a high silver purity of around 90%.

They derive their ‘junk’ status from being valued chiefly for their composition rather than any special collector’s appeal, with recognizability from their issue date. Denominations range from dimes—especially pre-1965 silver dimes—to quarters, half-dollars, and sometimes even dollars, with silver dimes being one of the most popular and affordable forms of junk silver.

The fundamental value derived from the actual metal matters most for those investing in these pieces. Large accumulations might necessitate robust storage solutions like vaults, which can increase investment expenses.

Junk silver coins, including silver dimes, are a practical way to participate in the silver market and remain an accessible and reasonably priced option for those looking to engage with the market for this precious metal.

Factors to Consider When Choosing Silver Coins

Several factors should be considered when selecting silver coins for investment. Purity levels are paramount; most investment-grade silver coins have purity levels exceeding 99%, which enhances their value and resale potential.

The design of a coin can significantly affect its desirability. Coins with cultural or historical significance often attract more interest and higher premiums. Additionally, limited mintage can increase a coin’s value, as scarcity drives demand.

Authenticity is another critical factor. Verifying the authenticity of silver coins, especially those not accompanied by a certificate, is crucial to avoid counterfeit products and ensure the investment’s value. For greater assurance of authenticity and quality, investors should prioritize sovereign mint silver coins and official silver bullion coins, as these are government-backed, guaranteed for silver content, and produced by reputable national mints.

These considerations can help investors make informed decisions when building their silver coin portfolio.

Benefits of Investing in Silver Bullion Coins

Investing in silver bullion coins offers several benefits, attracting novices and experienced investors in the precious metals market.

As a more cost-effective option than gold, silver allows for accumulating greater physical holdings with an equivalent investment.

The best silver coins, such as the Silver Britannia, are notable for their high liquidity and ease of trade within leading bullion markets—traits that afford investors considerable versatility when it comes to modifying their portfolios swiftly.

Sovereign silver coins produced by official government mints are assured of quality and reliability. These coins benefit from government backing, which provides additional assurance of authenticity and value to investors. Silver bullion coins often share similar features with their gold counterparts, including design, purity, and advanced security measures, making them equally reputable and desirable for wealth protection.

Incorporating these tangible assets into one’s investment strategy can buffer against market volatility while safeguarding wealth amidst economic unpredictability and potential cyber threats inherent to digital financial instruments.

Holding onto silver has traditionally been perceived as an effective inflation hedge to uphold long-term purchasing power.

How to Buy Silver Coins Online

Purchasing silver coins online allows you to shop from anywhere, exposing you to a broader selection. Opting for reputable dealers with favorable feedback minimizes scam risks and assures quality assurance.

Before buying, always check the current silver spot price to ensure you are paying a fair market value for your coins. When considering your investment options, compare silver coins to silver bars—silver bars often have lower premiums over the spot price and come in a variety of sizes, making them a popular choice for investors focused on affordability and bulk purchases, while coins may appeal more to collectors or those seeking government-backed authenticity.

Buying silver coins is hassle-free: navigate to the dealer’s site, pick your desired coins, and proceed with the payment procedures. Confirm their authenticity by checking certificates or conducting physical checks to ensure safe and knowledgeable investments in silver coins.

Storing and Securing Silver Coins

Protecting your silver coin investment is crucial to preserving its value and appeal. Proper storage begins with choosing a secure location, such as a home safe or a professional storage facility, to safeguard your silver coins from theft or loss. Handling your silver coins with care is equally important—using gloves or holding coins by the edges can help prevent fingerprints, scratches, and other damage.

To further protect your collection, consider storing each silver coin in a protective capsule or album, which shields it from dust, moisture, and environmental factors that can cause tarnishing. It’s also wise to keep your silver coins in a cool, dry place, away from direct sunlight and extreme temperatures. For added security, diversifying your storage locations can help minimize risk in the event of unforeseen circumstances. By taking these precautions, you can ensure your silver coins remain in pristine condition and retain their value for years to come.

Investments and Risk Management

Incorporating a variety of asset classes into an investment portfolio mitigates risk. It potentially boosts gains compared to the limitations and vulnerabilities inherent in portfolios focused solely on one type of asset. Integrating silver coins within an investment strategy can confer stability and robustness. Silver coins are also valued for their role in wealth protection, especially during times of economic uncertainty, as they help safeguard purchasing power and long-term financial stability.

Silver coins, termed “junk,” possess tangible value derived from their material content and the appeal of historical importance. They connect holders with periods when silver featured prominently in everyday money.

Employing diversification for effective risk control coupled with judicious choices forms the cornerstone of a triumphant approach to investing.

Tax Implications of Investing in Silver Coins

Investing in silver coins can have important tax implications that every investor should understand. In the United States, silver coins are generally classified as collectibles, which means that any profits from their sale may be subject to capital gains tax. If you sell your silver coins for more than you paid, you may owe taxes on the gain. However, holding your silver coins for more than one year may qualify you for long-term capital gains rates, which are often lower than short-term rates.

It’s essential to keep detailed records of all your silver coin purchases and sales, including dates, prices, and quantities, to ensure accurate tax reporting and compliance with regulations. Because tax laws can vary by jurisdiction and may change over time, consulting with a qualified tax professional is highly recommended. By staying informed about the tax implications of investing in silver, you can make smarter decisions and maximize the benefits of your precious metals portfolio.

Summary

Investing in silver coins offers security, liquidity, and potential growth. From the American Silver Eagle to the historic Morgan Silver Dollar, each coin presents unique benefits tailored to collectors and investors.

Understanding the factors influencing silver coin investments, such as purity, design, and authenticity, can guide investors to make informed decisions.

As we navigate the evolving landscape of precious metals in 2024, silver remains a robust and accessible investment opportunity.

By diversifying portfolios with silver bullion coins, investors can hedge against economic uncertainties and inflation, ensuring a resilient and profitable investment strategy.

Frequently Asked Questions

What makes the American Silver Eagle a good investment?

Investing in the American Silver Eagle is wise because of its excellent liquidity, renowned status, and 99.9% pure silver content, enhanced by its attractive historical design. As the official silver bullion coin of the United States, the American Silver Eagle is government guaranteed, providing additional trust and security for investors.

These elements enhance its value as a precious metal and an asset collectors seek.

How does the Canadian Silver Maple Leaf prevent counterfeiting?

The Silver Maple Leaf from Canada incorporates advanced security features to thwart counterfeiting. These features include radial lines, a micro-engraved maple leaf with the last two digits of the year, and MintShield technology that helps prevent milk spots.

Together, these advanced security features reinforce its genuineness and boost its resilience over time.

What is the significance of the Austrian Silver Philharmonic's design?

The Austrian Silver Philharmonic is produced by the Austrian Mint and is the only silver coin denominated in euros among European coins, making it unique in its category.

The coin's design highlights Austria’s deep-rooted music tradition. The obverse features the Golden Hall of Vienna's Musikverein, renowned for hosting the New Year's Day concert, while the reverse features a selection of musical instruments. These reverse features not only emphasize the coin's cultural significance but also enhance its appeal to collectors and investors.

Its association with cultural importance adds to the coin’s market value.

Why are junk silver coins considered a practical investment?

The intrinsic value of junk silver coins, rooted in their actual silver content, renders them a viable investment for those interested in acquiring silver without the added cost associated with collectible values. Silver dimes, a common form of junk silver, are especially popular due to their 90% silver content, historical significance, and affordability.

Junk silver coins, including silver dimes, are a practical way to participate in the silver market. By emphasizing their inherent value based on metal content, these silver coins offer protection against economic fluctuations and inflationary pressures.

How do I ensure the authenticity of silver coins purchased online?

When buying silver coins online, opt for reputable dealers who are recognized and have garnered favorable testimonials. Ensure to request certificates of authenticity to establish the legitimacy of your purchase.

Conduct thorough visual checks for discrepancies to verify that you're obtaining authentic silver coins.

Related Articles

I'm Stephen Pfeil, founder of Global Coin, and today I'm sharing something that, by all rights, ...

Discover More

A Monumental Achievement: The Ultimate 40-Year American Silver Eagle Proof Set

I'm Stephen Pfeil, founder of Global Coin, and today I have the privilege of sharing an extraord...

Discover More

What It Would Take for Me to Sell My Coins

People assume that if the price is right, everything is for sale. I understand why. We live in a ...

Discover More

3 comments

Can you review the desirabilty and value of coin sets. For example, I have several sets of Bahamas coins from the Franklin mint. Also sets from Belize and other Caribbean countries.

Thank you

Doug

Dr. Douglas A. Russell

I like your website

Henry A Mccullum

I like your website

Henry A Mccullum

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.