How Bullion Coins Protect Against Currency Devaluation

Hello, I'm Stephen, founder of Global Coin, where we specialize in post-1986 rare coins and precious metals. With over two decades in the numismatic world, I've seen firsthand how economic shifts can impact wealth. Today, in 2025, with ongoing global...

Hello, I'm Stephen, founder of Global Coin, where we specialize in post-1986 rare coins and precious metals. With over two decades in the numismatic world, I've seen firsthand how economic shifts can impact wealth. Today, in 2025, with ongoing global uncertainties, understanding how bullion coins can safeguard your assets is more crucial than ever. In this comprehensive guide, we'll dive into how bullion coins act as a hedge against currency devaluation and exchange risks, drawing on historical data, expert insights, and real-world examples. Whether you're new to investing in gold bullion coins or silver bullion coins, this post will equip you with the knowledge to protect your financial future.

What Is Currency Devaluation?

Currency devaluation occurs when a country’s currency loses value relative to other currencies or goods. This can happen due to inflation, economic policies, or external pressures like trade imbalances and fluctuating exchange rates. For instance, when governments print more money to stimulate the economy, the increased supply dilutes the currency’s purchasing power. Historically, the U.S. dollar has lost over 96% of its value since the Federal Reserve’s inception in 1913, largely due to such devaluation.

The process of devaluation typically involves a country officially lowering the value of its national currency, either by adjusting a fixed exchange rate system, selling its own currency in the open market, or implementing other monetary policy measures. Devaluing the domestic currency can result in higher exports by making a country’s exports more competitive and affordable to foreign buyers, while also leading to higher import prices for foreign goods, which impacts domestic consumers and domestic industries. This shift can attract foreign investment, as lower currency values make assets and services more appealing to international investors, but it also affects the country’s exports, imports, and overall economy. Exchange rates are influenced by both market forces—such as supply and demand in the foreign exchange market—and government interventions, including the use of foreign exchange reserves to support or devalue the currency. However, devaluation can have a negative impact, such as increased costs, inflation, and potential loss of competitiveness, prompting major trading partners to offset these effects with their own measures, like tariffs. For example, in 2015 and 2019, China devalued its currency in response to trade tensions with President Donald Trump and other countries, leading to international responses and shifts in global markets. Devaluation can have a direct influence on market price, the cost of services, and economic growth, and the type of system—fixed or floating—determines how easily a country can devalue its currency. Different countries manage their currency's value through various means, such as using foreign currency reserves, adjusting interest rates, and considering the impact on finance and competitiveness in global markets.

Devaluation erodes savings in fiat currencies, making everyday items more expensive. Think of hyperinflation scenarios like in Zimbabwe or Venezuela, where paper money became nearly worthless. In contrast, precious metals like those in coin and bullion form maintain intrinsic value because they can’t be printed at will, which directly benefits consumers.

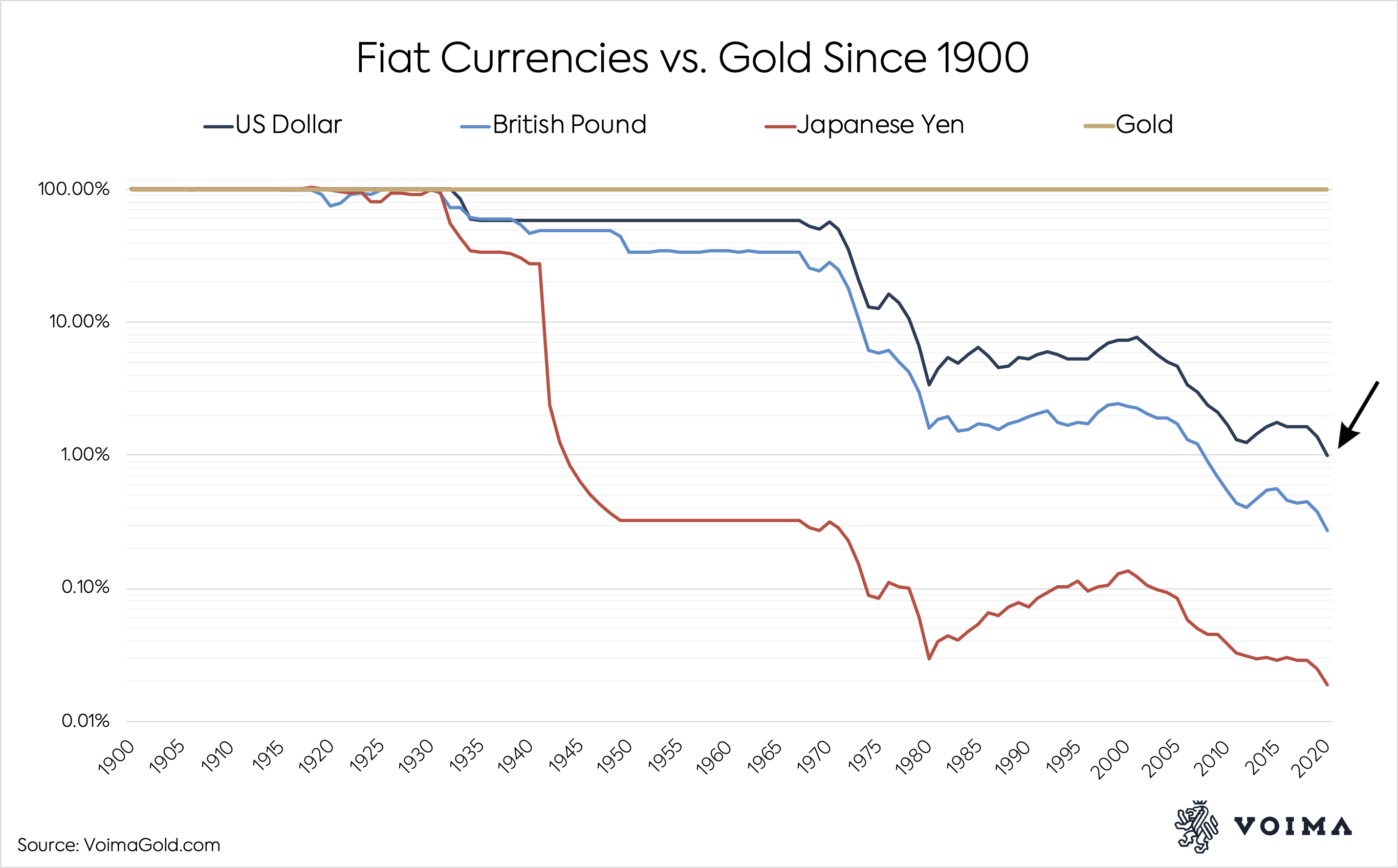

To illustrate, here’s a graph showing the long-term devaluation of the U.S. dollar against gold prices:

U.S. Dollar Devalues By 99% Vs. Gold In 100 Years - Gold Price …

This chart highlights how gold has consistently outpaced currency depreciation, preserving wealth over time.

The Role of Bullion Coins in Protecting Wealth

Bullion coins are government-minted coins valued primarily for their precious metal content, such as gold or silver, rather than numismatic rarity alone. Unlike stocks or bonds, which carry counterparty risk, physical bullion coins offer tangible ownership. You hold them directly, providing privacy and control—no banks, central bank, or intermediaries needed.

Here's how they protect against devaluation:

-

Hedge Against Inflation: As currencies weaken, the demand for precious metals rises, driving up their prices. Gold and silver have historically appreciated during inflationary periods, offsetting losses in fiat money.

-

Intrinsic Value and Scarcity: Precious metals are finite resources. Gold, for example, can't be created out of thin air, making it a reliable store of value.

-

Diversification: Adding bullion to your portfolio reduces overall risk. During economic downturns, when stocks plummet, gold and silver often hold steady or increase in value.

-

Liquidity: Bullion coins are easily bought and sold worldwide, ensuring you can convert them to cash quickly if needed.

Physical possession is key—it's why investors turn to bullion during crises, as seen in the 2008 financial meltdown or recent inflationary spikes.

Another visual aid: This graph compares gold prices to U.S. currency depreciation, showing gold's resilience:

INVESTING IN GOLD: Gold VS. US Currency Depreciation

Gold Bullion Coins: The Ultimate Hedge

Gold bullion coins, like American Eagles or Canadian Maple Leafs, are prized for their purity (often .9999 fine gold) and government backing. Gold has been a hedge against currency devaluation for centuries because its value tends to rise when fiat currencies fall or decrease . If the dollar collapses, gold prices could soar, as investors flock to safe-haven assets.

At Global Coin, we focus on post-1986 issues, which often combine investment value with collectible appeal. For example, modern gold coins from reputable mints offer liquidity and potential numismatic premiums.

Here are some popular gold bullion coins:

Silver Bullion Coins: Affordable Protection

Silver bullion coins provide similar benefits at a lower entry point. With industrial demand in electronics and renewables, silver often outperforms gold during economic recoveries. They're an excellent way to diversify against devaluation in currency and manage costs effectively.

Post-1986 silver coins, like those from the Royal Canadian Mint, are highly sought after for their purity and designs. Our inventory includes rare 2025 releases that blend bullion value with historical significance.

Visual examples of silver bullion coins:

Q&A: Common Questions About Bullion Coins and Currency Devaluation

To address your top concerns:

How to Protect Against Currency Devaluation?

Diversify into physical assets like bullion coins. Start with a mix of gold and silver to balance stability and growth potential. Store them securely and consider professional grading for added value, especially when making payments in uncertain economic times .

How Do I Protect My Money If the Dollar Collapses?

Invest in tangible assets. Gold bullion coins have historically retained value during currency crashes, as seen in past hyperinflations.

Is Gold a Good Hedge Against Currency Devaluation?

Absolutely. Gold's scarcity makes it inflation-resistant, often appreciating when currencies weaken.

What Is the Most Inflation-Resistant Currency?

No fiat currency is truly inflation-proof, but gold and silver act as "currencies" that have endured for millennia, outlasting many paper monies.

What Happens to Gold If the Dollar Crashes?

Gold prices typically surge as investors seek safe havens, protecting your wealth from devaluation.

Conclusion

In an era of potential currency devaluation, bullion coins offer a proven shield for your wealth. From gold's steadfast value to silver's versatility, incorporating them into your financial portfolio is a smart move. At Global Coin, we're committed to providing top-tier post-1986 rare coins and precious metals to help you thrive.

Ready to safeguard your future? Shop our premium coins today at https://shopglobalcoin.com/collections/all-products and start building your resilient portfolio. If you have questions, reach out—I'm here to help.

Stephen, Founder of Global Coin

Related Articles

Ancient Coins from Maritime Powers: Exploring Historical Coins in Gold, Silver, and Electrum

The invention of coinage transformed the ancient world by facilitating trade. Coins were invented...

Discover More

The Evolution of Coin Design: History, Design, and Collectibility

In today’s world of digital transactions, physical coins and other forms of currency remain timel...

Discover More

Investing in Gold Coins With Unusual Weight Variants

Disclaimer: Global Coin is a dealer of precious metal coins and does not provide investment, fina...

Discover More

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.